Month-end bank reconciliation is one of the most

common time-consuming activities when trying to close the month. With a

few process changes bank reconciliation can be performed daily.

Month-end bank reconciliations simply become one more daily activity.

Describing the process to accomplish daily bank reconciliations is the focus of this recipe.

Getting ready

Before a company can

perform daily bank reconciliations, bank reconciliations need to be

current. If a company's reconciliations are out of balance the accounts

will need to be balanced to the last statement before moving to daily

reconciliations.

Additionally, companies will

need access to the daily transactions from their bank. In most cases

this information can be easily downloaded from the bank's website for

transactions through the previous day.

How to do it...

Daily bank reconciliations do a great job of spreading the work. Let's see how:

1. Download and print the company's bank transactions from the bank's website for the period since the last reconciliation.

2. Select Financial from the Navigation Pane and click on Reconcile Bank Statements on the Financial Area Page.

3. Use the lookup button (indicated by a magnifying glass) to select a bank account to reconcile.

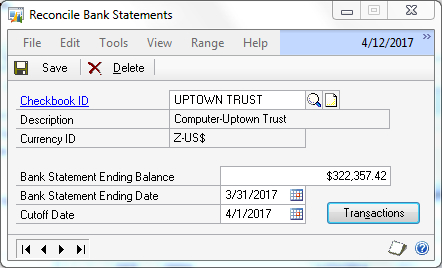

4. In the Bank Statement Ending Balance field, enter the ending bank balance for the previous day from the bank's website printout. Use yesterday's date for the Bank Statement Ending Date and today's date as the Cutoff Date:

5. Click on Transactions to start the reconciliation.

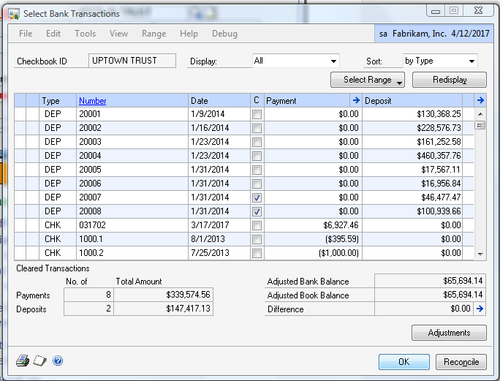

6. Select the checkboxes for completed transactions and complete a typical bank reconciliation, but DO NOT press Reconcile

once the difference reaches zero (0). Select the checkboxes for matched

transactions on the website printout and save that for tomorrow. This

helps avoid confusion about which checkboxes were selected and which

weren't:

7. Click on OK to return to the Reconcile Bank Statements window and click on Save to save the partial reconciliation.

8. Each day repeat these steps until the bank statement arrives at month end.

9.

When the bank statement arrives review the statement against the bank

reconciliation in Dynamics GP. I have seen a few situations where the

website and the paper statement differ. Only then should the Reconcile

button be clicked on and reconciliation reports printed for storage.

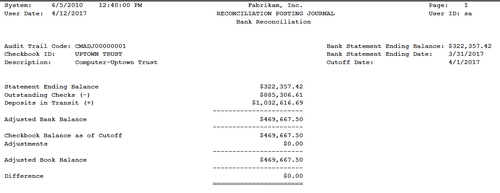

The following image is a printout of one such reconciliation report:

How it works...

Daily bank

reconciliation is really just the disciplined application of basic bank

reconciliation principles. The easy availability of bank information via

the bank's website combined with Dynamics GP's ability to save

incomplete bank reconciliations makes this an easy recipe to apply.

Additionally, other benefits include a better understanding of the

company's bank float, faster identification of fraudulent transactions,

and an up-to-date cash position.

There's more...

A common objection is that

this is still time consuming for larger organizations and high-volume

accounts but this is a hollow excuse as options are available for larger

transaction volumes as well. There is, however, one little hiccup when

dealing with the bank statement cutoff.

High Transaction Volume Accounts

For high transaction volume

bank accounts Microsoft provides an optional electronic bank

reconciliation module. This allows companies to take a file from the

bank and electronically match it to the bank statement. Where most

companies go wrong is that they only get the file on a monthly basis. If

there is an error it's even harder to find in a high volume account at

month end.

Companies in this situation

should work to get a daily electronic reconciliation file from the

bank. Often, firms chafe at the extra costs from their bank but rarely

do they take a hard look at the returns provided by not having employees

chasing bank transactions during month end. The stress of month-end

closing is also reduced because errors are found earlier in the month,

providing time for resolution before a month-end deadline.

Bank statement cutoff

Typically, there are a

few days of mailing delay between the bank statement cutoff and

delivery. For this period of a few days daily bank reconciliation can't

be completed. The problem is that reconciliations would go beyond the

end of the statement period making it impossible to print bank

reconciliation reports that match the statement.

There are a couple of options

to deal with this issue. The simplest is to just wait for a couple of

days and catch up after the statement arrives and the final month-end

reconciliation is processed. Another option is to process the

reconciliation against the website data only and attach the daily

website printout along with the bank statement and balance reports as

evidence for auditors.