Most companies have a need for some minimal level of

deferrals and accruals. This could be insurance prepaid for the year

that needs to be expensed over 12 months. It could be prepaid revenue

that is earned in the first half of the year but not billable until year

end or any number of similar transactions. For straightforward accruals

and deferrals Dynamics GP's recurring batch functionality can be used

to manage, track, and post these types of transactions. In this recipe,

we'll look at how to set up and process accruals and deferrals using

recurring batches.

Getting ready

For our example, assume

that corporate insurance is due and paid on January 1, and the payment

covers January through December of that year. For simplicity sake,

corporate insurance is $12,000 a year and the company is going to

recognize $1,000 per month until the full amount is used up.

The payables transaction for

$12,000 debited Prepaid Expenses, a balance sheet account, not insurance

expense. That's the key setup piece.

How to do it...

Now that we understand the background we'll look at how to set up recognition of the monthly expense:

1. On the Navigation Pane select Financial. Click on the Batches option on the Financial Area Page under Transactions.

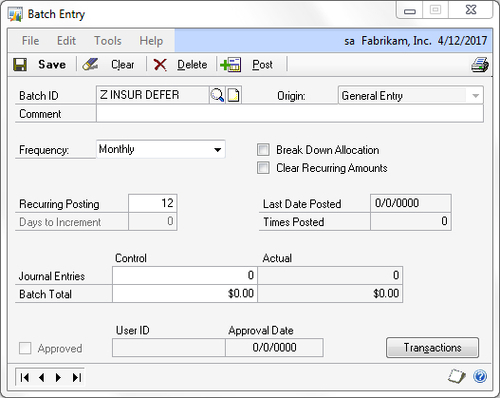

2. Enter Z INSUR DEFER in the Batch ID field and set the Origin to General Entry.

3. In the Frequency field select Monthly. Enter 12 in the Recurring Posting field and click on the Transactions button:

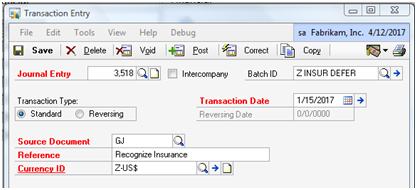

4. Set the Transaction Date to January 15 to process the first month's expense and set up the recurring transaction.

5. Type Recognize Insurance in the Reference field:

6.

Use the lookup button (indicated by a magnifying glass) to find the

Insurance Expense account and enter a debit for $1,000. On the line

above use the lookup button to find the Prepaid Expenses account and

process a credit for $1,000:

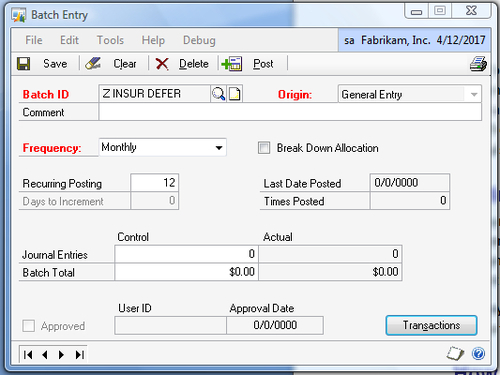

7. Click on Save to save the transaction. Close the Transaction Entry window and reopen the Batch Entry window. Use the lookup button (indicated by a magnifying glass) to reopen the Z INSUR DEFER batch and click on Post:

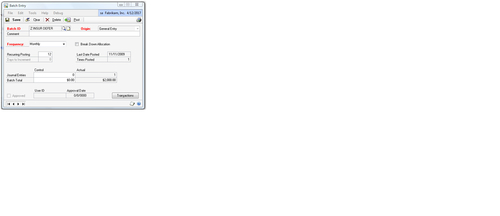

8. Use the lookup button (indicated by a magnifying glass) to find the Z INSUR DEFER batch again. Unlike single-use batches, the batch doesn't disappear after posting. The batch now contains the Last Date Posted and the number of times it has been posted (as shown in the following screenshot). When the number of times posted equals the Recurring Posting number, the batch will then disappear:

How it works...

Recurring batches

provide an opportunity to slowly use up deferral or build up an accrual

amount. Posting these recurring batches is easy. The batches provide

information about when these were last posted. This process can be added

as a reminder to ensure that posting is completed on time. The ability

to date the transaction means that the actual posting process can occur

any time during the month and the transaction will post as of the date

set in the transaction. This provides another opportunity to reduce

month-end work since this month's accruals and deferrals can be posted

at the beginning of the month.

There's more...

A few simple best practices can make recurring batches even more effective.

Recurring batch best practices

A couple of simple best

practices can provide even more value to recurring batches. Recurring

batches are mixed in with other batches in the batch window. Naming

recurring batches to start with an underscore (_) will put these batches

at the top. Starting the batch name with a 'z' will put these at the

bottom.

Since batches will

typically be posted multiple times covering several months it's

important to date the batch with a date that will appear in each month.

For example, batches dated for the 30th will cause the posting in

February to revert to the last day of the month and never move back to

the 30th. This gets even more important when using fiscal months that

can end on odd dates. When using a 4-4-5 fiscal period I've seen months

end as early as the 20th. Typically, using the 15th of the month is a

great option that will work in all situations.

For those companies that need to manage more than a few accruals or deferrals Microsoft provides additional options.

Revenue/Expense Deferral module

For companies with a large

number of deferrals to track Microsoft provides an available

Revenue/Expense Deferral module. This module is designed for processing

accrual and deferral transactions and is a great option when recurring

batches aren't enough.

Field Service Contracts module

For companies that need to

track revenue deferrals related to customer contracts a better option is

the Contracts module, part of the Field Service suite, also available

from Microsoft.